From Clicks to Conversions — How Social Commerce Is Redefining Brand Growth in Asia

From livestream shopping to platform-native payments, social commerce is reshaping Asia’s digital economy. Learn how to turn clicks into conversions in 2025.

Asia isn’t just keeping pace with digital retail evolution — it’s setting the standard. In 2025, social commerce in Asia has matured from trend to transformation, reshaping how consumers engage with products, influencers, and platforms.

In this blog, we break down the future of digital retail in Asia. From live commerce marketing strategies to platform-native payments and e-commerce trends shaping Asia in 2025, we explore how your brand can translate engagement into sales — and clicks into conversions.

The Rise of Social Commerce in Asia: Why the Region Leads the Way

Asia’s digital consumers aren’t browsing — they’re buying. Social commerce has grown beyond influencer posts and affiliate links to become a fully integrated shopping experience across platforms like TikTok, Xiaohongshu, Instagram, and Lazada Live.

What is Driving Social Commerce Growth in Asia?

Social commerce in Asia thrives due to several region-specific advantages:

Mobile-first user base: Over 88% of internet users in Southeast Asia access the web via mobile (Statista, 2024).

Platform integration: E-commerce features are embedded directly into apps like TikTok and WeChat, reducing friction.

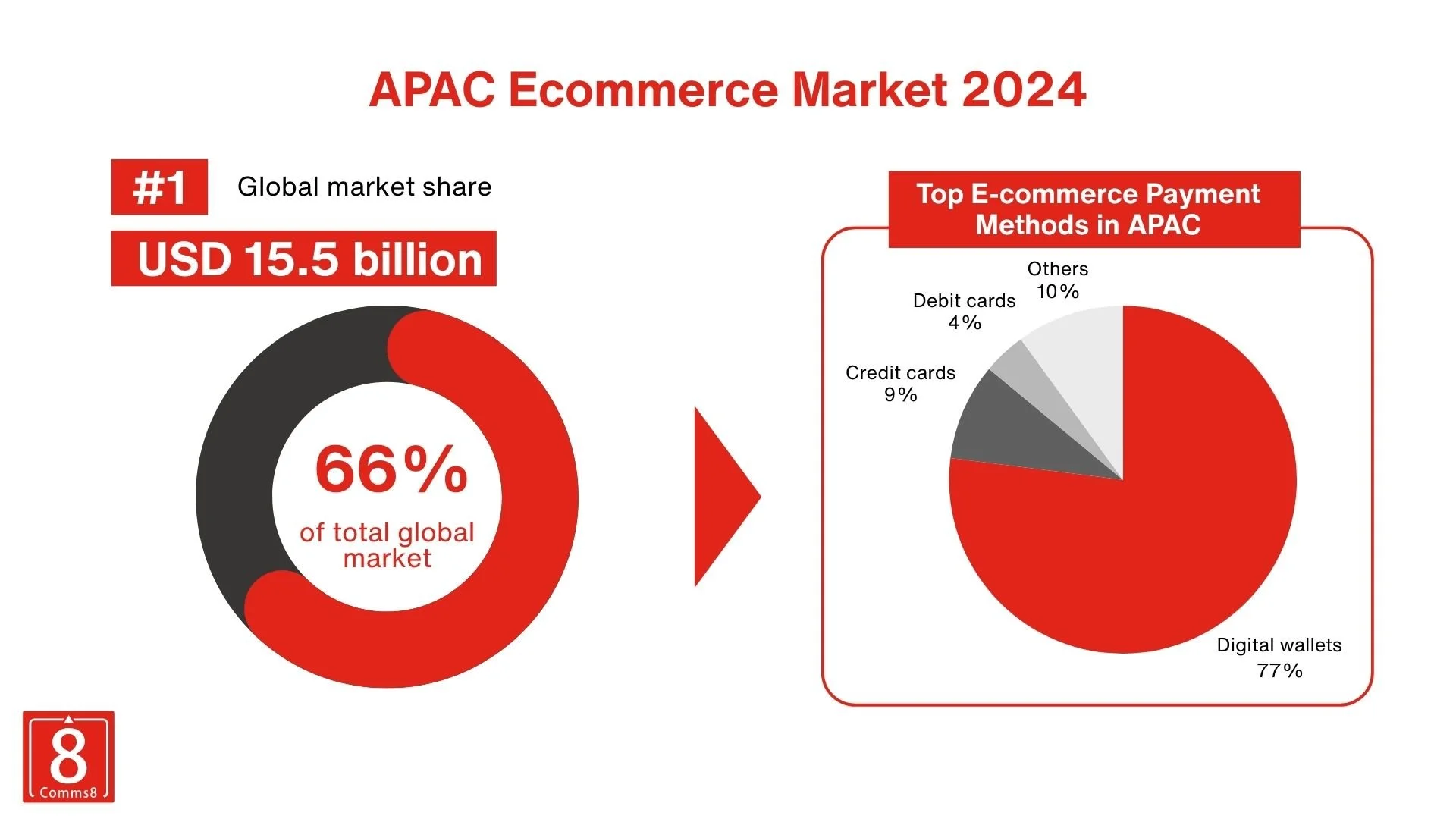

Digital payment ubiquity: From e-wallets to QR codes, Asia leads in seamless transaction tech.

Influencer trust: KOLs (Key Opinion Leaders) hold significant sway, especially among Gen Z and Millennials.

According to Bain & Company (2024), Southeast Asia’s social commerce market is projected to reach USD $90 billion by 2026, more than doubling from 2022. In countries like Thailand and Vietnam, up to 60% of online purchases are influenced by social media.

Live Commerce: Asia’s New Conversion Engine

In a region where speed, storytelling, and personalisation matter more than ever, live commerce has emerged as a dominant marketing and sales force.

Why Is Live Commerce Booming?

Live commerce blends entertainment and instant shopping — creating urgency and emotional connection. Unlike static product pages, livestreams offer:

Real-time product demonstrations

Immediate Q&A with sellers or KOLs

Flash deals and time-sensitive discounts

Social proof through live comments and peer validation

In China alone, live commerce sales reached ¥4.9 trillion (approx. $680 billion) in 2024, up 30% YoY (iiMedia Research, 2025).

Key Markets Leading the Trend

China: The world’s largest live commerce market, dominated by platforms like Taobao Live, Douyin, and Kuaishou.

Vietnam & Thailand: Experiencing rapid adoption, with TikTok Shop driving localised seller-led content.

Malaysia & Indonesia: Blending entertainment with live selling on platforms like Shopee Live and Lazada Live.

Did you know? In Vietnam, TikTok Shop sellers using live commerce experienced 50% higher conversion rates than traditional product listings (TikTok for Business, 2025).

Elements of a Winning Live Commerce Marketing Strategy

To maximise ROI, brands must treat live commerce as a strategic funnel — not just a flashy campaign. Here’s what works:

Pre-live engagement: Schedule events, tease offers, and collaborate with KOLs ahead of time.

Narrative selling: Blend storytelling with clear product USPs.

Cross-platform promotion: Promote across WeChat, RED, LINE, or WhatsApp to drive multichannel attendance.

Localised interaction: Use regional slang, emojis, and cultural references to increase relatability.

Platform-Native Shopping and Payment: Where Frictionless Meets Familiar

Turning interest into transaction requires more than engagement — it needs infrastructure. In Asia, platform-native shopping and localised payment methods are removing the final barriers between attention and action.

How Are Asian Platforms Shortening the Purchase Funnel?

Traditional e-commerce follows a multi-step journey: see the ad, go to a landing page, add to cart, check out. Social commerce platforms eliminate these steps.

TikTok Shop: Purchases happen within the video feed.

WeChat Mini Programs: Offer brand-owned storefronts with no app download required.

LINE Shopping (Japan): Combines messaging, coupons, and checkout in-app.

According to Meta (2025), 72% of Gen Z users in APAC have purchased products directly from a social media app — bypassing traditional websites entirely.

The Rise of Localised Payment Solutions

A key enabler of this shift is the region’s fast-evolving payment ecosystem. Here’s how platforms are adapting:

Indonesia & Philippines: Mobile wallets like GoPay and GCash dominate.

Thailand: QR code payments via PromptPay are nearly ubiquitous.

Vietnam: Momo and ZaloPay offer integration with TikTok Shop and Shopee.

Tazapay (2025) reports that over 68% of online shoppers in Southeast Asia prefer local payment methods over international credit cards.

Why This Matters for Foreign Brands

Foreign brands often overlook localisation beyond language. But in Asia, friction at checkout — whether it's unfamiliar currency, unrecognised payment methods, or complex UX — is the biggest conversion killer.

To win, brands must:

Partner with payment aggregators familiar with local systems

Implement dynamic currency conversion and QR code payments

Use regional loyalty or cashback features to retain users

The Bigger Picture: Social Commerce & Asia’s Digital Retail Growth in 2025

Social commerce is no longer a bolt-on strategy — it’s central to digital retail growth in Asia. For brands, this evolution presents both urgency and opportunity.

What E-Commerce Trends Are Shaping Asia in 2025?

Hyperlocal content: Shoppers want content that reflects their dialect, lifestyle, and local influencers.

AI-powered personalisation: Platforms are delivering smarter product suggestions based on real-time behaviours.

Social-led discovery: Over 60% of Gen Z in Asia discover new brands via social media — not search engines (Supermom Business, 2025).

Voice commerce: Particularly growing in multilingual, mobile-first markets like India and Indonesia.

What’s Next for Brands in Asia?

Social commerce isn't just an Asia trend — it's the future of e-commerce globally. But Asia is several steps ahead in terms of:

Consumer openness to mobile-first experiences

Trust in influencers and peer-driven content

Adoption of digital wallets and in-app payments

If you’re a foreign brand looking to expand, Asia offers unmatched potential — but only for those who adapt fast, localise deeply, and think beyond the “add to cart” button.

Final Thoughts: Turning Engagement into Results

Social commerce in Asia is more than a shift in how people shop — it’s a cultural, technological, and behavioural evolution. From livestreams to QR checkouts, it offers brands a chance to not just sell, but connect, convert, and scale.

Key Takeaways

Live commerce delivers higher engagement and conversion — especially with local influencers and time-sensitive offers.

Platform-native commerce shortens the buyer journey, making frictionless payments essential.

Localisation is no longer optional — it’s the linchpin of brand success in Asia.

And if you’re looking for a KOL or influencer, InfluenConnect offers the perfect platform to connect you with over 105,000 Chinese and Asian KOL. Click here to learn more about InfluenConnect.

For more in-depth insights, follow Comms8 where we help your brand expand into foreign markets.

At Comms8, we specialise in helping businesses leverage the power of cross-border marketing in Asia. With our expertise, we can assist you in harnessing the influence of social commerce strategies to boost your brand’s credibility and awareness. Contact us today to learn more about empowering your brand in the dynamic market.