Luxury e-Commerce in China: Unlock Growth With These 5 Expert Tips

A sleeping giant awakens.

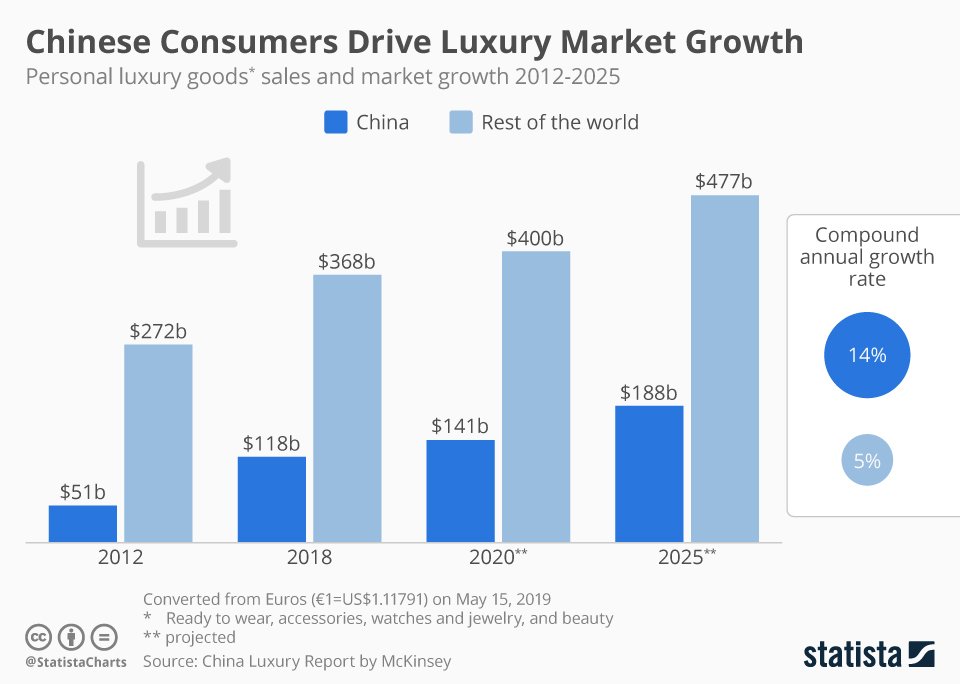

China’s e-commerce market is undergoing an unprecedented boom, and the luxury sector is no exception. With a projected value of $919 billion by 2025, this digital dragon presents an opportunity too lucrative to ignore.

GenZ and millennials are the driving force behind this explosive growth. They are tech-savvy, mobile-first, and crave a uniquely personalised experience that extends beyond just clicking a button. Brands that want to capture their hearts and wallets must transform their approach.

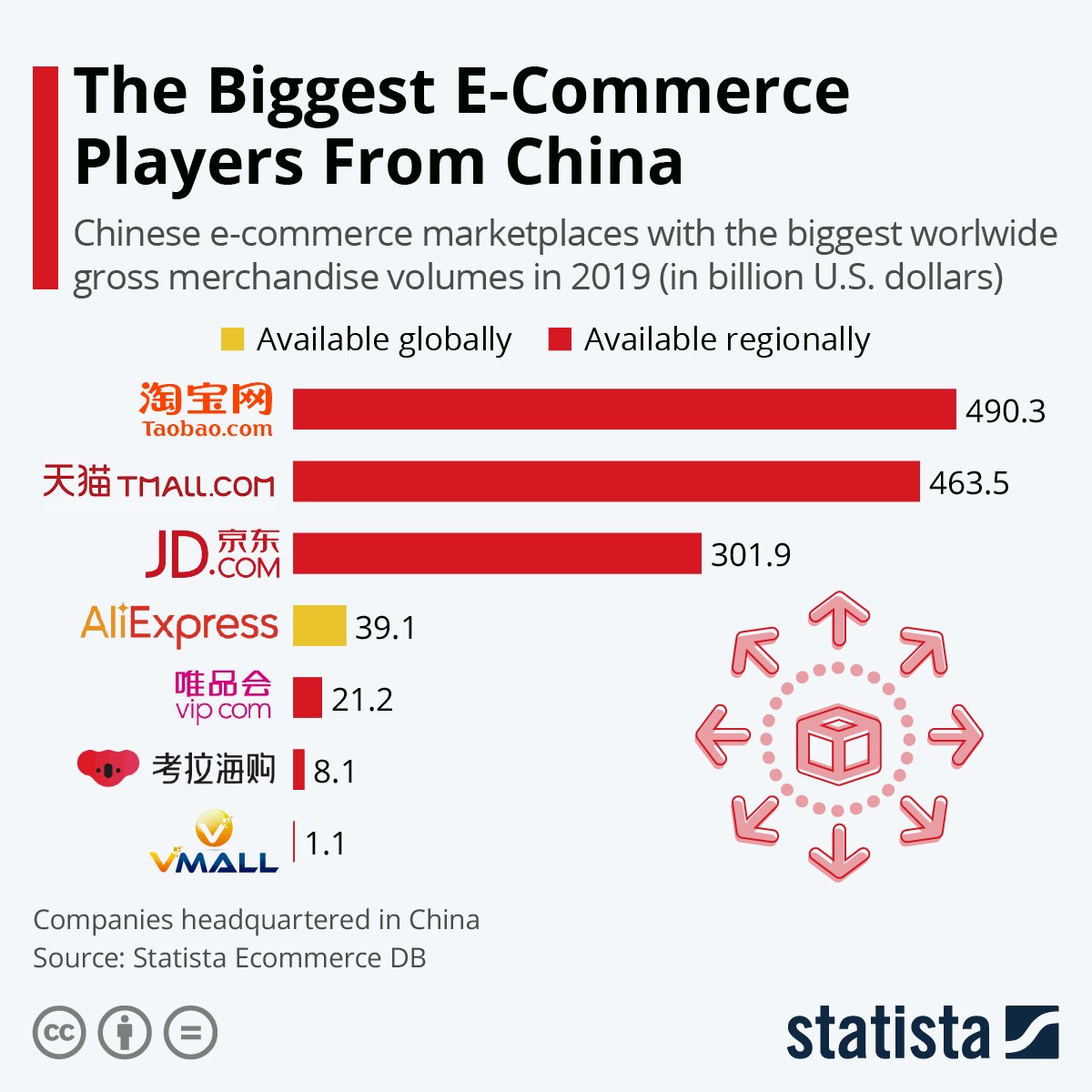

A recent survey on luxury goods purchases in mainland China revealed a fascinating trend: nearly 56% of online luxury shoppers opted for JD.com for their purchases in the past year. Meanwhile Tmall, Taobao, and Luxury Pavilion collectively captured a respectable 53% share.

For luxury brands, this presents an unprecedented opportunity to tap into a vast and lucrative market. Chinese consumers’ insatiable appetite for luxury propelled the market to a staggering $53.61 billion in 2022, capturing a 25% share of the global market, second only to the US.

This remarkable growth is driven by a surge in demand for goods like luxury watches and jewellery, which together accounted for nearly half of all luxury sales.

Credit: Cosmetics China Agency

Luxury e-Commerce in China: What’s the best business model?

China is now the world's largest e-commerce market, with more than 800 million active online shoppers.

Despite a boom in online luxury sales, China's e-commerce platforms are still searching for the ideal business model. Here’s a look at the challenges they face and analyzes the strategies of major players like JD.com, Net-a-Porter, and Farfetch.

The Elusive Model

Platforms must choose between a marketplace (commission on sales) or buyer-led (inventory ownership) model. Even giants like JD.com have struggled, with their Toplife platform eventually merging with Farfetch China. Luxury brands now have options like mini programmes on JD Fashion, offering greater control over the customer experience.

The Importance of Service

As consumer choice expands, traditional e-commerce must offer added value through services. Net-a-Porter China's EIP personal styling consultancy serves as a successful example. This focus on core customers demonstrates the potential returns of personalised service.

Brands Take Control

Farfetch acquired Curiosity China to assist luxury brands with digital strategy and services. Their pre-order service allows brands to produce only pre-sold items, reducing waste and inventory pressure. Brands like Bulgari are opting for shop-in-shop models on platforms like Tmall, maintaining control over key aspects. This trend suggests that brands hold the power in the current landscape.

Credit: Statista

The Chinese Luxury Consumer: Gen Z and Millennial Power

As younger generations, Gen Z and Millennials, gain purchasing power, they are driving growth in both online and offline high-end retail markets across China.

Research from McKinsey reveals a unique trend among these demographics. Unlike their predecessors, Gen Z and Millennials are less loyal to specific brands, instead valuing unique experiences and personalization highly.

Influenced by social media giants like WeChat and Weibo, as well as digital influencers (KOLs or Key Opinion Leaders), these emerging consumer groups are shaping trends within the Chinese luxury market:

Seek innovative products: With a constant influx of new trends and brands, Gen Z and Millennials value novelty and are more likely to try new brands and products.

Prioritise sustainability: These generations are conscious of environmental and ethical issues, and they are increasingly seeking out sustainable luxury brands that align with their values.

Digitally driven: Social media plays a crucial role in their purchase decisions. KOLs like Angelababy, Yang Mi, and Tiffany Tang wield immense influence, driving trends and shaping purchase decisions for their millions of followers.

The influence of these digital influencers cannot be overstated: their recommendations can make or break a brand in the Chinese market.

Credit: Vogue Business

5 Expert Tips To Expand Your Presence in the Chinese Market

Seamless omnichannel shopping: Integrating online and offline experiences is crucial. This could involve features like online appointment booking for in-store consultations or virtual try-on technology.

Seamless omnichannel shopping: Integrating online and offline experiences is crucial. This could involve features like online appointment booking for in-store consultations or virtual try-on technology.

Exclusive content and experiences: Offer exclusive products, personalized offers, and access to behind-the-scenes content so that it helps build brand loyalty and exclusivity.

Engaging social media presence: Chinese consumers are heavily influenced by social media. Brands need to be active on platforms like WeChat and Weibo, creating engaging content and collaborating with influencers.

Exceptional customer service: Provide excellent customer service. It is almost a necessity, especially for luxury brands. This includes offering multilingual support, fast and reliable shipping, and easy returns.

Local platform power: Developed specifically for the Chinese consumer, local platforms offer a potent gateway to vibrant and engaged communities. WeChat’s pioneering services have reshaped the social media landscape, while Alibaba’s cross-border e-commerce stores set the bar for user experience and design.

Brands that can successfully navigate these demands will be well-positioned to capture a significant share of the Chinese luxury market.

Here are some examples of how luxury brands are already succeeding in China's e-commerce landscape:

Burberry: Partnered with Alibaba's Tmall platform to launch a dedicated online store, offering exclusive products and engaging social media campaigns.

Gucci: Launched a WeChat mini program to offer personalised product recommendations and virtual try-on experiences.

L'Oréal: Partnered with Chinese KOLs to promote its products on social media and live streaming platforms.

These brands are leading the way and demonstrating the immense potential of e-commerce for luxury brands in China.

By embracing the unique demands of Chinese consumers and leveraging the power of e-commerce, luxury brands can unlock a new era of growth and success in the world's most dynamic market.

Credit: Marketing To China

Top 10 Online Luxury Retailers in China

The rise of e-commerce and digital tools has driven luxury retailers to embrace online platforms, not only to enhance customer service but also to tap into the global market.

These top 10 online luxury retailers have successfully navigated the Chinese market by adapting their strategies to cater to the specific needs and preferences of Chinese consumers.

Farfetch

This global giant boasts an extensive network of partner boutiques, offering a curated selection of luxury fashion items from established and emerging brands. Farfetch’s focus on personalised shopping experiences and exclusive collaborations has resonated well with Chinese customers.

JD.com

Known for its robust logistics and commitment to authenticity, JD.com has carved a niche in the Chinese online luxury market. The platform offers a diverse range of luxury goods, from fashion and beauty to electronics and homeware, catering to the varied preferences of Chinese consumers.

Tmall Luxury Pavilion

Owned by Alibaba, Tmall Luxury Pavilion provides a prestigious platform for luxury brands to showcase their latest collections and engage with Chinese consumers. The platform's emphasis on authenticity, high-quality product presentations, and exclusive marketing campaigns has attracted many leading luxury brands.

Secoo

A pioneer in China's online luxury market, Secoo specialises in offering a curated selection of high-end fashion and lifestyle products. The platform's focus on personalised customer service and exclusive partnerships has earned it a loyal following amongst Chinese luxury shoppers.

RED

This social commerce platform has become a powerful tool for luxury brands to reach out to Chinese consumers. RED’s unique blend of social media features, influencer marketing, and e-commerce capabilities allows brands to engage with potential customers in a dynamic and interactive manner.

Poizon

Focusing on pre-owned luxury goods, Poizon has established itself as the go-to platform for Chinese consumers seeking authentic luxury items at discounted prices. The platform’s stringent authentication process and user-friendly interface have fostered a thriving community of luxury enthusiasts.

Mytheresa

This German online retailer offers a curated selection of designer clothing, shoes, and accessories for women. Mytheresa's focus on high-quality product photography, editorial content, and seamless customer service has resonated with Chinese consumers seeking a sophisticated online shopping experience.

Forward

This platform specialises in offering limited-edition and hard-to-find luxury fashion items. Forward's focus on unique product offerings and curated collections has attracted a niche audience of fashion-forward Chinese consumers.

24S

Owned by the LVMH group, 24S offers a wide range of luxury fashion items from brands within the group's portfolio. The platform's focus on exclusive collaborations and high-quality content has attracted Chinese consumers seeking a curated selection of luxury goods.

Ssense

This Canadian online retailer offers a curated selection of luxury fashion, streetwear, and contemporary brands. Ssense's focus on emerging and independent designers, alongside established brands, has attracted Chinese consumers seeking a unique and trend-driven shopping experience.

The focus on authenticity, high-quality product offerings, personalised service, and innovative marketing campaigns have enabled these luxury retailers across China to thrive in this dynamic and competitive market.

Credit: Statista

In 2023, Chinese consumers are driving a surge in online luxury purchases, with a growing number of people in developing countries like India, Southeast Asia, and Brazil joining the ranks of luxury enthusiasts. This trend is forcing luxury brands to adapt their marketing strategies and embrace digital channels to reach their target audience.

As the online luxury market continues to grow, we can expect to see even more innovative digital marketing strategies emerge. Some of the key trends to watch for include:

The rise of artificial intelligence (AI): AI-powered chatbots and personalised product recommendations can further enhance the online shopping experience for luxury consumers.

The use of virtual reality (VR): VR technology can create immersive experiences that allow consumers to virtually visit luxury stores and try on products in a realistic setting.

The integration of blockchain technology: Blockchain can improve supply chain transparency and authenticity, which is increasingly important for luxury consumers.

By embracing these digital trends, luxury brands can ensure that they are well-positioned to capitalise on the growing demand for luxury goods in China and other developing markets.

For more such in-depth insights, follow Comms8 where we help your brand expand into foreign markets.

At Comms8, we specialise in helping businesses leverage the power of cross-border marketing in Asia. With our expertise, we can assist you in harnessing the influence of marketing strategies to boost your brand's credibility and awareness. Contact us today to learn more about empowering your brand in the dynamic Asian market.