The Rising Dragon: China’s Growing Control on Global Car Market and Why the EU is Probing Chinese Subsidies

China is on the brink of becoming a major global exporter of automobiles.

Did you know that China's share of the European electric car market has grown by more than 200% in less than two years? This is due to China’s efforts to become a leader in the transition away from gasoline and diesel cars.

The UK is the biggest European market for Chinese electric car brands. Almost a third of all new electric car sales in the UK in the first seven months of 2023 were from Chinese brands. This is the second-largest market share in Europe, after Sweden.

Sales of Chinese electric cars in Europe are growing quickly. In the first seven months of 2023, Chinese carmakers sold almost as many electric cars in Europe as they did in the whole of 2022.

On October 4, 2023, the European Union formally launched an anti-subsidies probe into electric vehicles manufactured in China. The outcome of the EU’s investigation could have a major impact on the balance of power in the global electric vehicle market.

Credit: Statista

The Rise of Electric Vehicles

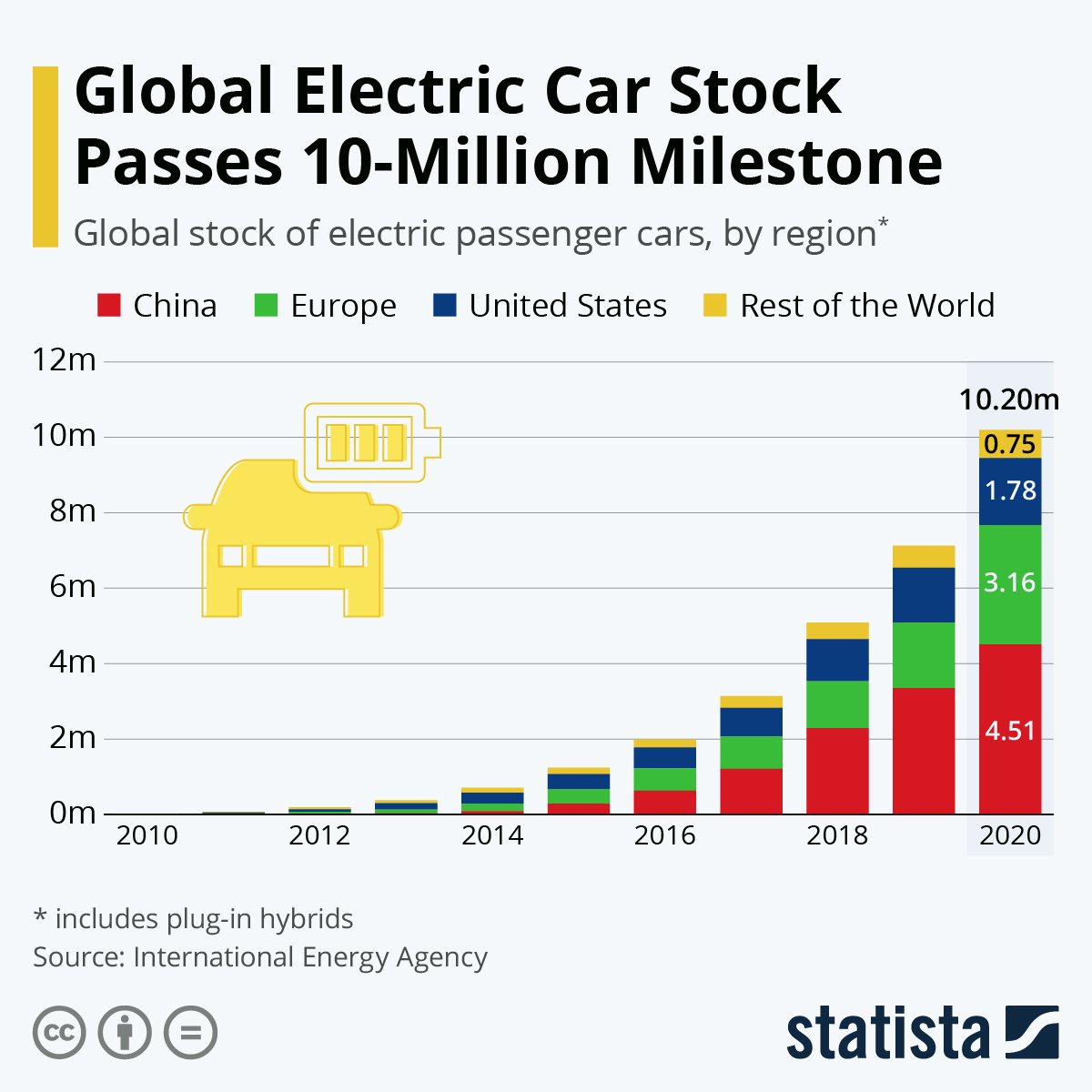

Electric car sales are growing rapidly, with over 10 million sold in 2022. The share of electric cars in total sales has also increased sharply, from 4% in 2020 to 14% in 2022. This trend is expected to continue in 2023.

Consumers now have more choices when it comes to electric vehicles (EVs), as manufacturers have introduced a wider range of models, including larger vehicles. Previously, compact cars were the only EV options available, but trucks and SUVs now account for a significant share of new vehicle sales. Dozens of new EV models are expected to be released by 2024.

China’s electric car exports surged in 2022, accounting for 35% of global electric car shipments, up from 25% in 2021. Europe is China’s largest market for electric cars and batteries, and in 2022, Chinese-made electric cars captured a 16% share of the European market in 2022, up from 11% in 2021.

Credit: Statista

China’s Cars Go Global: Auto Exports Soar to New Heights

China is now the world’s largest car exporter, surpassing Japan for the first time in history. In the first half of 2023, China exported 2.34 million vehicles, while Japan exported 2.02 million vehicles.

This milestone marks a significant shift in the global auto industry, as China has traditionally been a net importer of vehicles.

China’s rise to the top of the global car export market is driven by a number of factors, including:

Rapid growth in the domestic electric vehicle (EV) market. China is now the world’s largest EV market, with sales of over 25% new car sales in 2022. Chinese EV makers, such as BYD and MG, are also expanding globally.

Government support for the auto industry. Chinese government subsidies have bolstered the auto industry for decades, providing subsidies to domestic and foreign automakers alike. Not only has it created a strong domestic auto industry but also made Chinese vehicles more competitive in the global market.

Weakening demand in other major car exporting countries. Slow demand for electric cars in other countries, such as Japan, Germany, and South Korea, has created a golden opportunity for Chinese automakers to gain market share.

The rise in Chinese car exports sparks concerns of global market disruption. Experts worry Chinese automakers’ low costs could undercut rivals and drive them out, or that China could pressure other countries to adopt its EV standards.

Despite these concerns, it is clear that China is now a major player in the global auto industry.

Credit: Statista

Europe at the Centre of China’s Global Expansion

China has set its sight on the one thing it still lacks: Western car markets. And, Europe is at the heart of its electric vehicle expansion. Chinese automakers are expanding into the country by building showrooms and signing deals with existing dealers. They argue their vehicles are crucial to meet the world’s clean energy goals.

The target is to sell 8 million passenger vehicles overseas by 2030—more than twice Japan’s current shipments.

However, in Europe, which aims to ban the sale of new petrol cars by 2035, Chinese EVs are both a solution and a challenge. Chinese brands are offering something that Europe’s renowned automakers cannot yet match: affordable EVs for the masses. Many climate-conscious European consumers are eager to buy a vehicle that helps them reduce their reliance on fossil fuels at an affordable price.

Credit: Merics

What are Chinese Carmakers’ ‘Going Global’ Strategies?

Chinese carmakers have adopted a “going global” strategy, with the aim of expanding their market share beyond China’s borders.

In 2022, Geely Automobile sold over 1.36 million vehicles overseas, which accounted for 22% of its total sales. And BYD sold over 593,000 vehicles overseas, a 38% increase from the previous year. Now, it has plans to expand its production capacity to 3 million units per year by 2025.

Here are five key goals they are meeting through their strategies:

Focus on electric vehicles (EVs)

Chinese carmakers are well-positioned to lead the global EV market, thanks to their early investment in EV technology and their access to China’s massive EV supply chain. Many Chinese automakers are now exporting EVs to key markets such as Europe and the United States.

Partner with established automakers

Chinese carmakers are also partnering with established automakers to gain access to their global distribution networks and manufacturing expertise. For example, Geely has acquired Volvo Cars and Daimler AG, while SAIC Motor has partnered with General Motors and Volkswagen AG.

Build local manufacturing plants

To reduce costs and improve delivery times, Chinese carmakers are building local manufacturing plants in key markets. For example, BYD has built EV factories in the United States and Europe.

Acquire foreign brands

Chinese carmakers are also acquiring foreign brands to gain access to their brand equity and customer base. For example, Geely acquired the Volvo and Polestar brands, while SAIC Motor acquired the MG brand.

Focus on emerging markets

Chinese carmakers are also focusing on emerging markets, where there is strong demand for affordable and fuel-efficient vehicles. For example, Chery Automobile has a strong presence in Latin America and Africa.

Chinese carmakers are also investing heavily in research and development, and are developing new technologies such as autonomous driving and self-parking. They are also working to improve the quality and design of their vehicles.

As a result of these strategies, Chinese carmakers are becoming increasingly competitive in the global automotive market. They are expected to play a major role in the future of the global auto industry.

Probe Begins: EU Examines Chinese Subsidies in EV Market

The European Union (EU) launched an investigation into the imports of battery electric vehicles (BEV) from China on October 4, 2023, and its major concern is whether China is giving its electric vehicle makers unfair subsidies. This move shows that the EU is increasingly worried about competition from China, both in industry and in geopolitics. The investigation could lead to trade restrictions, such as taxes on Chinese electric vehicles imported into the EU.

European automakers are trying to make more battery-powered vehicles, but they are worried that they cannot compete with Chinese models that are cheaper because of Chinese government subsidies.

“Europe is open to competition, but we will not race to the bottom,” said Ursula von der Leyen, the president of the European Commission, in a speech in Strasbourg, France. “We must protect ourselves against unfair practices.”

Von der Leyen announced the investigation in her annual state of the EU address, which sets the agenda for the year ahead.

“China believes that the investigative measures proposed by the EU are actually to protect its own industry in the name of ‘fair competition,’” a ministry spokesperson said in a statement.

“It is a blatantly protectionist act that will seriously disrupt and distort the global automotive industry chain and supply chain, including within the EU, and it will have a negative impact on China-EU economic and trade relations,” the spokesperson said.

The European auto industry employs about 13 million people, or about 7% of the total workforce, according to the European Automobile Manufacturers' Association (ACEA). In Germany, the auto industry is at the center of the country's economy, with brands like Volkswagen, Audi, BMW, and Mercedes-Benz.

German economy minister Robert Habeck welcomed the European Commission’s investigation, Reuters reported. “This is about unfair competition, it’s not about keeping efficient cheap cars out of the European market,” he said.

Credit: Tippinsights

Sharing insights on the recent developments, several people took to X (Twitter) to address their concerns. Here’s what people think about China’s rise in global electric vehicle exports.

“China’s economy is in a huge, historic transition. Its production of technologies like solar panels and electric vehicles has skyrocketed. The Chinese government intentionally deflated the housing bubble, and now state-owned banks are funding a massive expansion of manufacturing, especially in the renewable energy industry.”

“China already represents 80+% of global investment in renewable energy manufacturing. China is leading the world in the green transition (while many US politicians openly reject climate science). But Western media outlets are distracted by their own absurd manufactured claims that China’s economy is ‘collapsing’,” wrote Ben Norton.

Another account @Sentletse posted, “I now see why the EU is upset over cheaper Chinese electric vehicles. This Changan Qiyuan A07 is half the price of a Tesla. China is not playing.”

A third X user wrote, “Yes China is at the forefront of electric vehicles (EV) adoption. But the problems are now coming out as more cars are on the road, especially during a mass exodus for holidays. People stuck forever waiting to recharge the battery. EU regulators should watch and take note.”

For more such news and insights, follow Comms8 where we help your brand expand into foreign markets. Contact us today to learn more about empowering your brand in the dynamic Asian market.