China’s E-Commerce Shopping Festivals: 3 Ways To Unlock Billions in Sales

China’s e-commerce market is a goldmine, with online sales in 2022 reaching RMB 14.2 trillion (approximately $2.1 trillion). Alibaba, the e-commerce giant, saw $84.5 billion in sales on Singles’ Day in 2022, China’s largest e-shopping festival.

Another major e-shopping festival is 618, which is celebrated by JD.com, one of Alibaba’s main competitors in China. In 2023, JD.com amassed $111 billion in GMV during the 18-day festival.

Large shopping festivals in China offer significant opportunities for foreign businesses to sell their products. Chinese shoppers love good deals, and these festivals are a great time for foreign businesses to boost sales, increase brand awareness, and reach Chinese consumers.

To enter China’s e-commerce market, you must intricately understand the online shopping festivals and know how to market your brand in each one of them. Here is a comprehensive guide to help you navigate the right strategies for the festive season.

Credit: Image by jcomp on Freepik

China’s Non-Stop E-Commerce Festivals

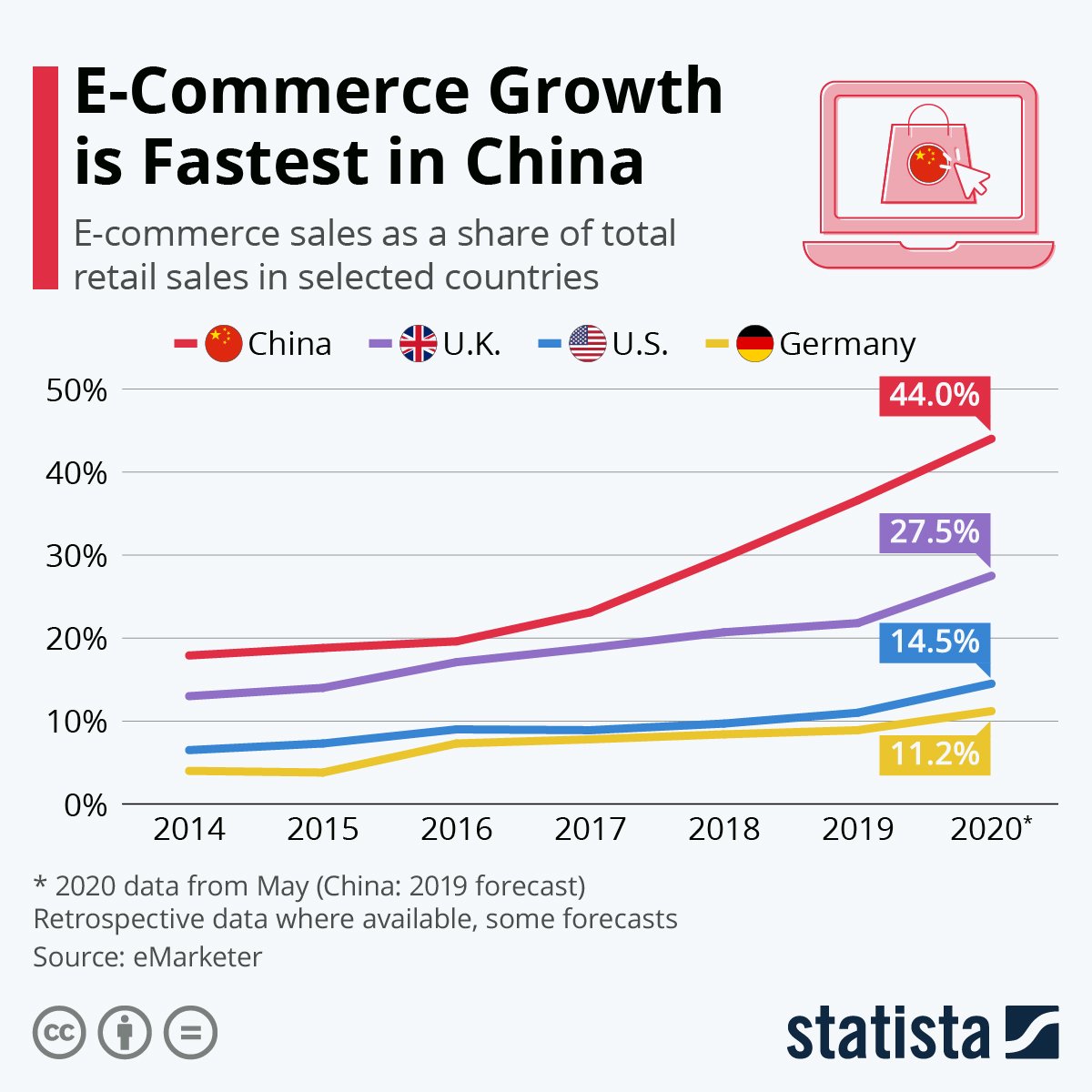

China’s transformation from traditional retail to global e-commerce dominance has attracted international attention, making it a desirable destination for businesses worldwide.

Some of the most famous Chinese shopping festivals are Singles’ Day, or Double 11, which takes place on November 11 each year; 618 Mid-Year Shopping Festival and the Double 12 Festival. Here is an overview of China’s biggest e-shopping festivals in 2023.

A Brief History

In the late 1990s, online shopping was still in its early stages worldwide. Founded by Liu Qiangdong on June 18, 1998, JD.com quickly became popular in those days and played a major role in the rapid growth of e-commerce in China.

A decade later, China became the world’s largest e-commerce market, accounting for nearly half of the global total. This was not a coincidence, but the result of careful planning and innovative solutions that have revolutionised the way people shop.

Today, China attracts millions of shoppers from all over the world. These festivals celebrate consumerism and offer amazing deals, discounts, and promotions on a wide variety of products. Some of China's most popular shopping festivals are Singles Day, Spring Festival, Valentine's Day, Mid-Autumn Festival, and 618 Mid-Year Shopping Festival.

Credit: Sinoanalytics

List Of Shopping Festivals In China

Singles’ Day (11.11)

Celebrated on November 11th, Singles' Day is the world's largest online shopping festival. It was originally created as a holiday for single people, but it has since evolved into a massive shopping event for everyone.

Also known as Double Eleven, it is a massive shopping event in China that was created by Jack Ma, the founder of Alibaba. It is celebrated on November 11, which is symbolised by the four ones in the date (11.11), which represent single life.

Singles’ Day was originally created as a day for China’s bachelors, but it has since evolved into a celebration for all singles. It is now the world's largest shopping day, with sales revenue reaching $17.8 billion in 2022.

While other e-commerce sites also participate in Singles’ Day promotions, it is essentially Alibaba's day. In 2014, Alibaba trademarked the name “Double Eleven” to prevent other retailers from using the same term.

Credit: Insider Intelligence

618 Mid-Year Shopping Festival

Celebrated on June 18th, 618 is the second-largest e-shopping festival in China after Singles’ Day. It was created by JD.com to celebrate its anniversary on June 18, but it has since become a major shopping event for all e-commerce platforms.

618 can be seen as JD.com’s response to Alibaba’s Singles’ Day shopping extravaganza, with similar deals and promotions leading up to the event. Other retailers also host sales on 618, but JD.com is the main focus.

While 618 does not generate the same level of sales as Singles’ Day, it is still a major shopping event, with over $15 billion in sales in 2023. JD.com’s market share has been slowly increasing, from 18% in 2014 to 25% in 2016, and it is likely that 618 will continue to grow in the coming years.

Credit: Insider Intelligence

The Double 12 Shopping Festival (12.12)

Double Twelve is a shopping event in China that takes place on December 12. It was created by Alibaba to appeal to shoppers who were not satisfied with the deals they got on Singles' Day, which takes place on November 11.

While Double Twelve does not reach the same sales heights as Singles' Day, it is still a major shopping event with sales figures that are impressive in their own right. In 2015, Alibaba's Taobao recorded around $13.2 billion in transaction volume on Double Twelve.

Double Twelve is a relatively new festival and has not yet gained the same level of popularity as Singles' Day. However, it is growing rapidly, and in 2016, total wireless transactions on Taobao on Double Twelve rose 45.8 percent over the previous year.

Credit: Hinrich Foundation

Other e-Commerce Festivals in China

Spring Festival (春节)

Celebrated in January or February during the Chinese New Year, the Spring Festival is the most important holiday in China. It is a time for family reunions and feasting, and it is also a major shopping season.

Gift-giving has been a tradition during this holiday for centuries. The most popular gifts are food and beverage products, electronics, and clothing. People often order gifts to be delivered to the homes of relatives who they will not be able to see during the holiday.

Valentine’s Day

Valentine’s Day is a popular shopping day in China for both couples and singles. Online retailers like Tmall and Jumei offer deals on popular gift items, such as makeup and perfume.

According to Kung Fu Data, an independent Chinese data firm, gross sales on Taobao and Tmall for flowers, bags, women's shoes, and accessories reached RMB 6.2 billion (approximately $911 million) on Valentine’s Day this year.

Mid-Autumn Festival (中秋节)

Celebrated in September or October, the Mid-Autumn Festival is another important Chinese holiday. It is a time for families to come together and enjoy mooncakes and other traditional foods. It is also a popular time for shopping.

By participating in these festivals, businesses can offer discounts and promotions, launch new products, and build brand awareness.

Red Friday (Black Friday)

Black Friday, the day after Thanksgiving in the United States, is a major shopping event with deep discounts on a wide range of products. Chinese shoppers are increasingly taking advantage of Black Friday deals to buy discounted foreign products through cross-border e-commerce platforms.

Rednote (Xiaohongshu / RED) runs a “Red Friday” sales event from late November to early December, offering discounts on foreign products from a variety of brands.

Credit: e-Commerce To China

Major Challenges for China’s Shopping Festivals in 2023

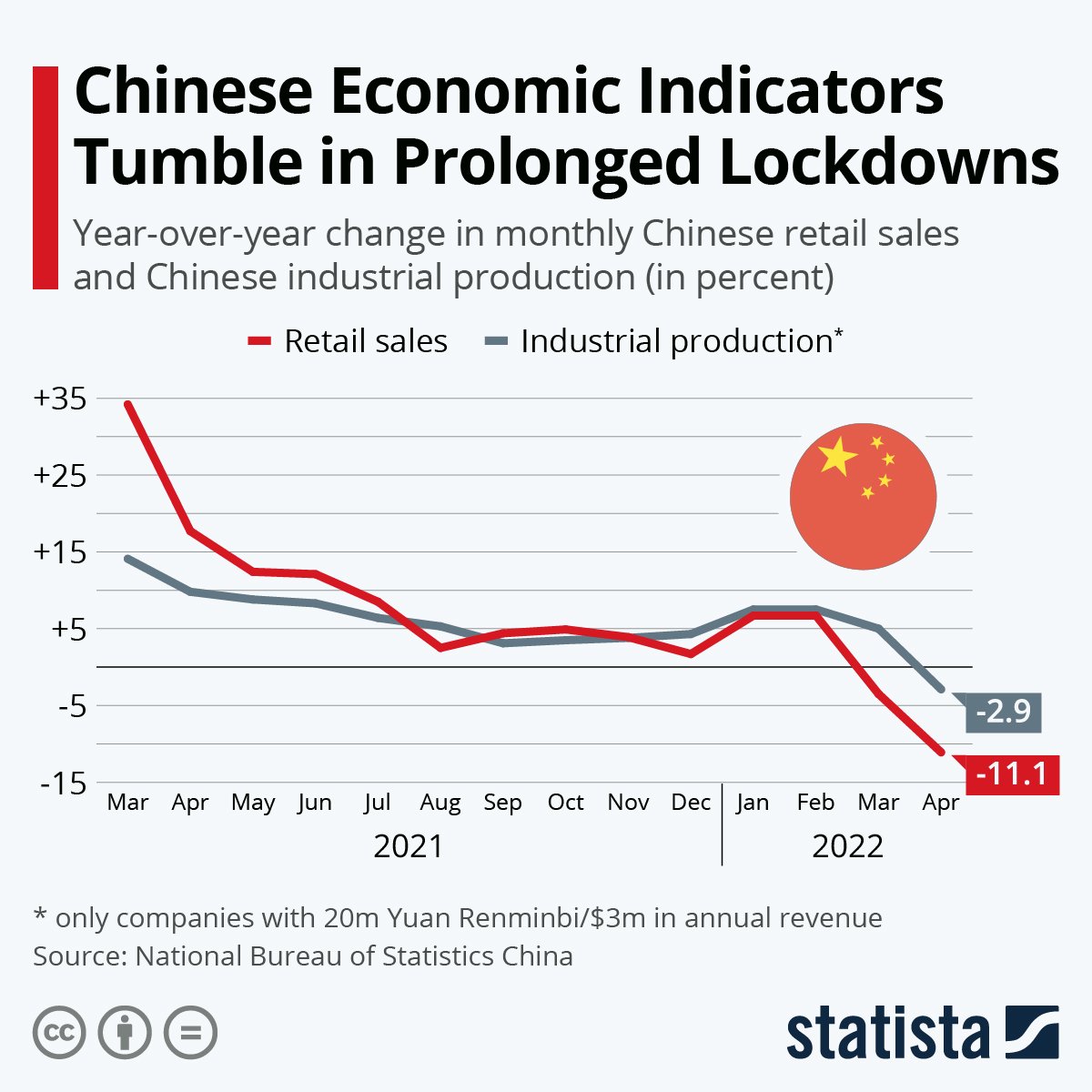

While Chinese e-commerce shopping festivals have evolved into carnivals over the years, 2023 witnessed a different trend. This year, its midyear shopping festival, 618, is not bringing as much joy to retailers. The Chinese economy is slowing down. Exports have plummeted, people are spending less, prices are not rising as fast, but more people are losing their jobs. The value of the Chinese currency has fallen.

Even though the e-commerce platforms are trying to convince people to spend money, most people are not interested.

Here are some of the most significant challenges facing China’s shopping festivals in 2023.

Slower growth in 2023 impacted by the economic downturn

China’s economy is expected to grow at a slower pace in 2023, down from 8.1% in 2021 to around 5.5%. This slowdown is due to a number of factors, including the global pandemic, the ongoing trade war with the United States, and the country's own ageing population.

Slower economic growth will likely lead to lower consumer spending, which will impact major shopping festivals like 618 and Singles’ Day. In 2022, sales at the 618 Festival grew at a slower pace than in previous years, and it is possible that we will see a similar trend in 2023.

Change of consumer logic due to the recession

The recession is also changing the way Chinese consumers think about spending. In the past, consumers were more willing to splurge on luxury goods and other discretionary items. However, now they are more cautious and are looking for value for money.

This change in consumer behaviour is making it more difficult for brands to sell their products during shopping festivals. Brands need to offer more compelling discounts and promotions to attract and retain customers.

New marketing and product positioning strategies

Post the recession, brands have to rethink their marketing and product positioning strategies. In the past, brands could rely on aggressive discounting to drive sales during shopping festivals. However, this is no longer enough.

Brands now need to focus on creating a strong brand image and offering unique products and services that meet the needs of Chinese consumers. They also need to use more sophisticated marketing strategies, such as social media marketing and influencer marketing, to reach their target audience.

In addition to the challenges mentioned above, brands also need to be aware of the following:

The increasing popularity of live streaming e-commerce: Live streaming platforms like Taobao Live and Douyin are becoming increasingly popular in China. Brands need to develop live streaming strategies in order to reach potential customers on these platforms.

The growing competition from domestic brands: Chinese consumers are increasingly becoming more supportive of domestic brands. Brands need to differentiate themselves from the competition by offering unique products and services.

The importance of sustainability: Chinese consumers are becoming more aware of the importance of sustainability. Brands need to demonstrate their commitment to sustainability in order to appeal to these consumers.

Credit: Statista

How Foreign Brands Can Leverage China’s Shopping Festivals

China’s e-commerce market is very competitive, and it can be challenging for new businesses to break into. Apart from Singles’ Day and 618, there are many other festivals throughout the year, such as 418 and 818, which are similar but smaller in scale. Western shopping festivals like Black Friday and Cyber Monday are also becoming more popular in China.

Foreign businesses can tap into the Chinese market by carefully studying its e-commerce festival trends. Developing detailed marketing strategies can help them reach valuable customers in China, where billions of people shop online.

Here are some strategies and tips to enter the Chinese shopping festival market.

Craft Targeted Marketing Messages

Tailor your marketing message to economic status and consumer trends for maximum impact. China is a vast country with a diverse range of consumers, so it is important to tailor your campaign message to the specific economic status and consumer trends of the region or audience you are targeting.

For example, in major cities like Beijing and Shanghai, consumers are more affluent and have a higher demand for luxury goods. In rural areas, consumers are more price-sensitive and may be more interested in basic necessities.

To adapt your campaign message, you can conduct market research to learn more about the specific needs and wants of your target consumers. You can also partner with local KOLs and influencers to get their insights on what kind of messaging will resonate with their followers.

Promote Early Bird Festival Offers & Discounts

Social media is a powerful tool to reach Chinese consumers. Platforms like WeChat and Weibo have over a billion active users, and many Chinese consumers use these platforms to research and purchase products.

To promote your festival deals on social media, you can create engaging content that highlights the value of your products and services. Early bird ticket discounts are a powerful way to incentivise people to buy tickets to your festival or event early. They can help you generate revenue early on, create a sense of urgency, and build excitement around your event.

The earlier you start offering discounts, the more time people have to plan and budget for your brand.

Collaborate with KOLs & Influencers

Key opinion leaders (KOLs) and influencers have a strong influence on Chinese consumers. Many consumers trust the recommendations of KOLs and influencers, and they are more likely to purchase products that have been endorsed by these individuals.

To collaborate with KOLs and influencers, you can reach out to them directly or partner with an influencer marketing agency. When choosing KOLs and influencers to work with, it is important to select individuals who have a strong following among your target audience.

Credit: Statista

Here are some additional tips for foreign brands leveraging China's shopping festivals:

Partner with e-commerce platforms. E-commerce platforms like Tmall and JD.com are the primary channels through which Chinese consumers shop online. To reach a wider audience, you should partner with these platforms and make your products available on their marketplaces.

Offer exclusive deals and discounts. Shopping festivals are a time when Chinese consumers are looking for the best deals. To attract shoppers, you should offer exclusive deals and discounts during these festivals. You can also offer limited-edition products or services to create a sense of urgency and excitement.

Provide excellent customer service. Chinese consumers expect excellent customer service, especially during shopping festivals. Make sure you have a team in place that can handle the increased demand during these periods.

By following these tips, foreign brands can leverage China’s shopping festivals to reach a wider audience, drive sales, and build brand awareness.

At Comms8, we specialise in helping businesses leverage the power of e-commerce shopping festivals in China. With our expertise, we can assist you in harnessing the influence of China’s shopping festivals to boost your brand’s credibility and awareness. Contact us today to learn more about empowering your brand in the dynamic Asian market.